Stay informed

Stay informed with what’s going on. Browse posts that might be helpful to you or check out an event happening in your area. Come back regularly as this page is kept up-to-date with a lot of relevant information.

When it comes to your savings, don’t let common TFSA mistakes tip you overboard. Read this article on the 4 mistakes to avoid and then let’s connect to discuss how I can help you.

Did you know you can still contribute to your 2025 RRSP before March 2, 2026? Get in touch with me to find out if that’s a good idea for you!

Family is everything! When you meet with me, we’ll discuss how you can plan to protect them no matter what life throws at you, the expected and the unexpected.

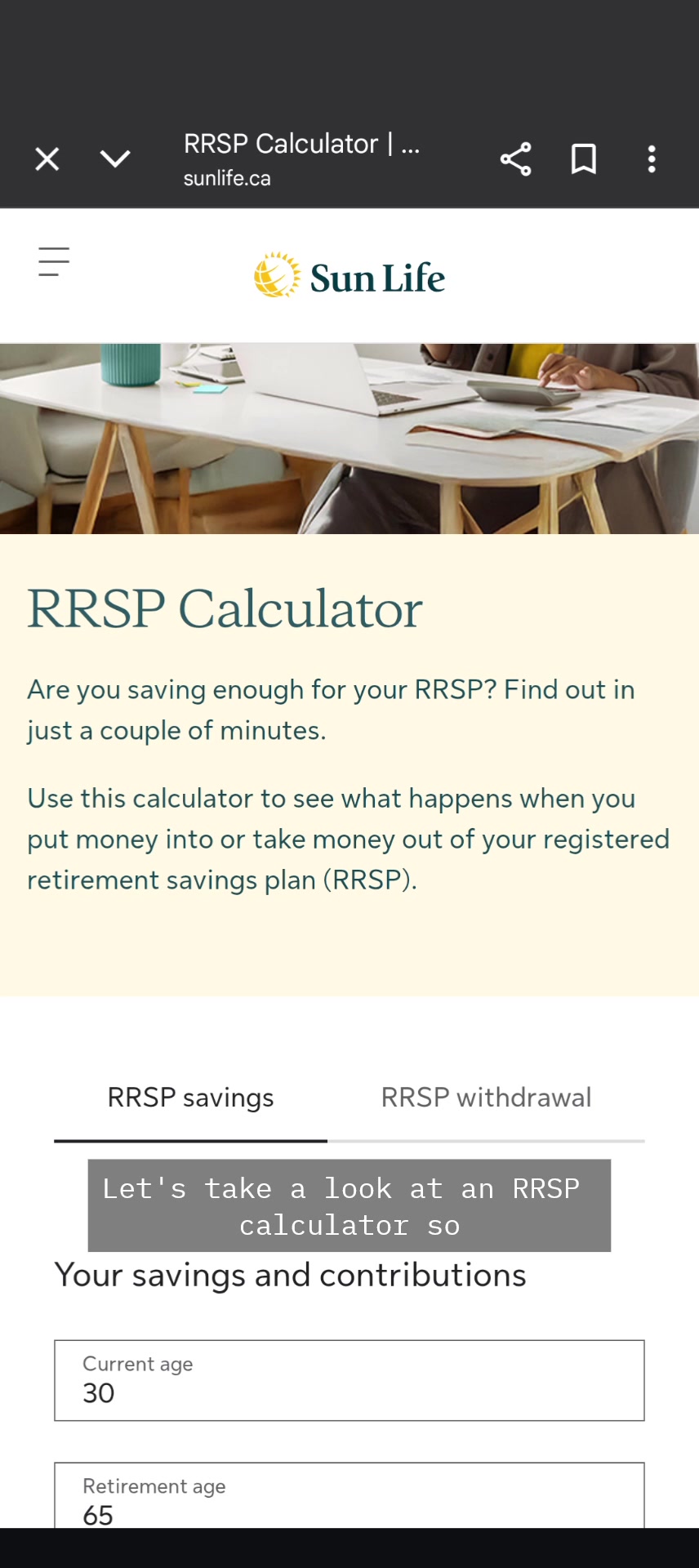

Are you saving enough in your RRSP for the retirement you want? Crunch the numbers in Sun Life's free RRSP calculator. Then, let’s connect and talk about your options.

https://www.sunlife.ca/en/tools-and-resources/tools-and-calculators/rrsp-calculator/

https://www.sunlife.ca/en/tools-and-resources/tools-and-calculators/rrsp-calculator/

Disability vs Critical Illness Insurance: What’s the Difference?

Critical Illness Insurance - What it Actually Pays For.

RRSP are incredibly powerful - but only when used properly!

With tax season on the horizon, it’s important to know your tax refund can be so much more than extra spending money. It can be a powerful investment tool.

When you contribute to your RRSP, you get a tax deduction that often leads to a refund. Instead of spending it right away, consider putting it back to work… reinvest that refund into your RRSP or RESP.

You’ll give yourself another tax advantage AND grow your savings faster, creating a positive financial cycle that keeps building year after year.

📈 A simple move today can set you up for a stronger tomorrow.

👉 Want help building a smart reinvestment strategy? Let’s chat!

#Investing #InvestSmart #InvestingTips #InvestmentStrategy #FinancialGrowth #WealthBuilding #LongTermInvesting #SmartInvesting #PersonalFinance #WealthManagement #FinanceGoals

When you contribute to your RRSP, you get a tax deduction that often leads to a refund. Instead of spending it right away, consider putting it back to work… reinvest that refund into your RRSP or RESP.

You’ll give yourself another tax advantage AND grow your savings faster, creating a positive financial cycle that keeps building year after year.

📈 A simple move today can set you up for a stronger tomorrow.

👉 Want help building a smart reinvestment strategy? Let’s chat!

#Investing #InvestSmart #InvestingTips #InvestmentStrategy #FinancialGrowth #WealthBuilding #LongTermInvesting #SmartInvesting #PersonalFinance #WealthManagement #FinanceGoals

Watch video

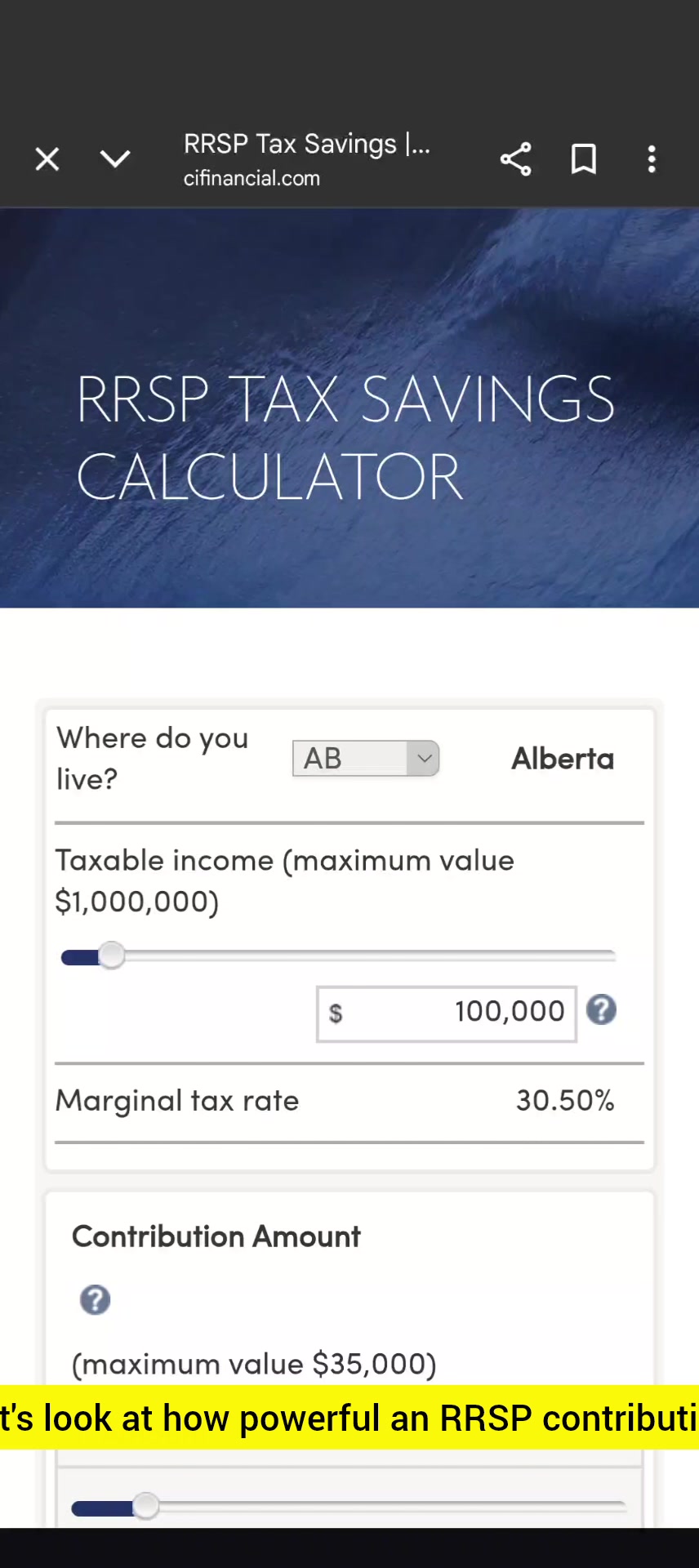

Watch the video to see how powerful an RRSP contribution can be, depending on

your income level. Have any questions? Let us know! We’d be more than happy to help.

#Investing #InvestSmart #InvestingTips #InvestmentStrategy #FinancialGrowth #WealthBuilding #LongTermInvesting #SmartInvesting #PersonalFinance #WealthManagement #FinanceGoals

your income level. Have any questions? Let us know! We’d be more than happy to help.

#Investing #InvestSmart #InvestingTips #InvestmentStrategy #FinancialGrowth #WealthBuilding #LongTermInvesting #SmartInvesting #PersonalFinance #WealthManagement #FinanceGoals

Watch video

Did you know, when saving for your kids’ education, you can open either an individual or family RESP?

👶 Individual RESP: One child/beneficiary per account. 👨 👩 👧 👦 Family RESP: Multiple kids/beneficiaries under one plan, giving you flexibility to move funds where they’re needed most.

If one child chooses not to attend post-secondary or earns a full scholarship, you can redirect the funds to another child, ensuring your hard-earned savings (and the government grants!) don’t go to waste.

💡 It’s a smart, flexible option for families planning ahead.

👉 Want to know which plan is right for your family? Let’s chat!

#RESP #EducationSavings #SaveForSchool #FutureEducation #ChildEducationFund #InvestInEducation #EducationPlanning #RESPContributions #KidsEducation #EducationGoals

👶 Individual RESP: One child/beneficiary per account. 👨 👩 👧 👦 Family RESP: Multiple kids/beneficiaries under one plan, giving you flexibility to move funds where they’re needed most.

If one child chooses not to attend post-secondary or earns a full scholarship, you can redirect the funds to another child, ensuring your hard-earned savings (and the government grants!) don’t go to waste.

💡 It’s a smart, flexible option for families planning ahead.

👉 Want to know which plan is right for your family? Let’s chat!

#RESP #EducationSavings #SaveForSchool #FutureEducation #ChildEducationFund #InvestInEducation #EducationPlanning #RESPContributions #KidsEducation #EducationGoals

Watch video

If you know us, you know we love finding ways to make life a little easier (and fun) while still planning for the future. That’s exactly why we’ve both set up regular contributions to our kids’ RESPs.

We’re talking about auto-deposits, topping up on birthdays, even having grandparents gift money through RESP’s instead of the usual presents at Christmas or birthdays. It’s become a little family tradition, and honestly, it feels really good knowing we’re building their future while keeping the holiday chaos a little simpler. 🎁💛

Just a friendly reminder: the RESP contribution deadline is December 31st, but to make sure everything is processed in time, please make sure you call our office and submit everything by December 18th.

How do you make saving for the future fun in your family?

#RESP #EducationSavings #SaveForSchool #FutureEducation #ChildEducationFund #InvestInEducation #EducationPlanning #RESPContributions #KidsEducation #EducationGoals

We’re talking about auto-deposits, topping up on birthdays, even having grandparents gift money through RESP’s instead of the usual presents at Christmas or birthdays. It’s become a little family tradition, and honestly, it feels really good knowing we’re building their future while keeping the holiday chaos a little simpler. 🎁💛

Just a friendly reminder: the RESP contribution deadline is December 31st, but to make sure everything is processed in time, please make sure you call our office and submit everything by December 18th.

How do you make saving for the future fun in your family?

#RESP #EducationSavings #SaveForSchool #FutureEducation #ChildEducationFund #InvestInEducation #EducationPlanning #RESPContributions #KidsEducation #EducationGoals

Imagine walking into retirement with a source of income that’s 100% tax-free. Sounds dreamy, right?

The truth is, having a tax-free income stream is one of the most powerful tools you can set up for your future. Every dollar you DON’T have to hand over in taxes is a dollar you can spend on making memories, enjoying peace of mind, or just living retirement your way.

The real magic happens when you’ve got a balanced mix of tax-free + taxable sources working together to give you a well-rounded, protected retirement plan.

Want to explore how tax-free income could fit into your retirement strategy? Let’s chat about your options.

#TaxFreeRetirement #RetirementIncome #SmartRetirement #RetirementReady #WealthPlanning #RetirementSavings #RetirementGoals #FinancialFreedom #MoneySmarts #RetirementDreams #InvestSmart #FinancialAdvisor #PlanForRetirement #MoneyMatters #FuturePlanning #FinancialWellness #RetireHappy #MoneyTips #WealthMindset #RetirementPlanning

The truth is, having a tax-free income stream is one of the most powerful tools you can set up for your future. Every dollar you DON’T have to hand over in taxes is a dollar you can spend on making memories, enjoying peace of mind, or just living retirement your way.

The real magic happens when you’ve got a balanced mix of tax-free + taxable sources working together to give you a well-rounded, protected retirement plan.

Want to explore how tax-free income could fit into your retirement strategy? Let’s chat about your options.

#TaxFreeRetirement #RetirementIncome #SmartRetirement #RetirementReady #WealthPlanning #RetirementSavings #RetirementGoals #FinancialFreedom #MoneySmarts #RetirementDreams #InvestSmart #FinancialAdvisor #PlanForRetirement #MoneyMatters #FuturePlanning #FinancialWellness #RetireHappy #MoneyTips #WealthMindset #RetirementPlanning

Watch video

With just over a month left in 2025, here’s our advice for 2026: Get your shit together. 😅

We know, it sounds blunt. But honestly, if everyone just got their financial stuff in order, it would make a HUGE difference.

Get organized. Stop ignoring it. Even if you have tons of money, ignoring it means missing out on opportunities… opportunities to grow, protect, and make the most of what you’ve built.

Consider this your friendly nudge: let’s make 2026 the year you take control, get everything aligned, and stop letting your finances run in the background.

💭 Let us know in the comments (or give us a call): what’s the one thing you want to get organized before the new year?

We know, it sounds blunt. But honestly, if everyone just got their financial stuff in order, it would make a HUGE difference.

Get organized. Stop ignoring it. Even if you have tons of money, ignoring it means missing out on opportunities… opportunities to grow, protect, and make the most of what you’ve built.

Consider this your friendly nudge: let’s make 2026 the year you take control, get everything aligned, and stop letting your finances run in the background.

💭 Let us know in the comments (or give us a call): what’s the one thing you want to get organized before the new year?

Don’t put off saving for your kid’s education. Don’t put off making contributions. Get that grant money (plus interest), ASAP. Just a heads up that our office deadline for those RESP contributions is December 18th. This will ensure we have enough time to process the paperwork and have everything finalized by the government deadline of December 31st.

#RESP #EducationSavings #SaveForSchool #FutureEducation #ChildEducationFund #InvestInEducation #EducationPlanning #RESPContributions #KidsEducation #EducationGoals

#RESP #EducationSavings #SaveForSchool #FutureEducation #ChildEducationFund #InvestInEducation #EducationPlanning #RESPContributions #KidsEducation #EducationGoals

Watch video

“Is it hard to get money out of an RESP?” 👀 It’s a super common question but the good news is, it’s usually not complicated at all. If we’ve got everything we need, you’ll typically have the money within a week. 🙌

What you’ll need: ✅ Proof of enrollment ✅ Clarity on what portion you’re accessing (grant money, your money, or interest earned)

Simple as that!

Have any RESP questions? Let’s chat through them so you feel confident about how (and when) to access those funds

#CanadianParents #CanadaRESP #InvestInYourKids #EducationSavingsPlan #FinancialPlanningCanada #EducationFundCanada #RESP #EducationSavings #SaveForSchool #FutureEducation #ChildEducationFund #InvestInEducation #EducationPlanning #RESPContributions #KidsEducation #EducationGoals

What you’ll need: ✅ Proof of enrollment ✅ Clarity on what portion you’re accessing (grant money, your money, or interest earned)

Simple as that!

Have any RESP questions? Let’s chat through them so you feel confident about how (and when) to access those funds

#CanadianParents #CanadaRESP #InvestInYourKids #EducationSavingsPlan #FinancialPlanningCanada #EducationFundCanada #RESP #EducationSavings #SaveForSchool #FutureEducation #ChildEducationFund #InvestInEducation #EducationPlanning #RESPContributions #KidsEducation #EducationGoals

Watch video

Today, we pause to remember and honour the brave men and women who have served and sacrificed for our country. 🕊️

Their courage and dedication allow us to live our lives with freedom and safety… something we should never take for granted.

Whether it’s a quiet moment of reflection, attending a ceremony, or simply wearing a poppy, let’s take a minute to show our gratitude and remember the incredible sacrifices made for all of us.

Lest we forget. ❤️

Their courage and dedication allow us to live our lives with freedom and safety… something we should never take for granted.

Whether it’s a quiet moment of reflection, attending a ceremony, or simply wearing a poppy, let’s take a minute to show our gratitude and remember the incredible sacrifices made for all of us.

Lest we forget. ❤️

Every parent knows the drill… tossing granola bars, yogurt tubes, maybe the occasional “surprise treat” into lunchboxes day after day. It doesn’t feel like much at the moment, but over time, it becomes part of the routine.

RESP contributions can work the same way. When you build it into your routine (just another step in the monthly rhythm) it stops feeling like “one more thing” and starts quietly building a future for your kids.

And bonus: the government will match up to 20% of the first $2,500 invested, annually. Not a bad, right? 😉

So while you’re quietly building routines, both in the kitchen and financially, we need to know: what’s your go-to lunchbox staple?

#FamilyFinance #FinancialPlanning #MoneyMatters #FinancialWellness #SmartMoneyMoves #FinancialFreedom #MoneyManagement #InvestInYourFuture #FinancialGoals

RESP contributions can work the same way. When you build it into your routine (just another step in the monthly rhythm) it stops feeling like “one more thing” and starts quietly building a future for your kids.

And bonus: the government will match up to 20% of the first $2,500 invested, annually. Not a bad, right? 😉

So while you’re quietly building routines, both in the kitchen and financially, we need to know: what’s your go-to lunchbox staple?

#FamilyFinance #FinancialPlanning #MoneyMatters #FinancialWellness #SmartMoneyMoves #FinancialFreedom #MoneyManagement #InvestInYourFuture #FinancialGoals

Ever wonder what a 10-year delay in saving for retirement could cost you? 👀

We ran the numbers using an RRSP calculator, and the difference is HUGE.

If you’re curious about how starting earlier (even with smaller amounts) can set you up for a way more comfortable retirement, this one’s for you.

#RetirementPlanning #RetirementGoals #FinancialFreedom #RetirementIncome #RetirementSavings #RetirementReady #SmartRetirement #FuturePlanning #RetirementStrategy #FinancialIndependence #WealthManagement

We ran the numbers using an RRSP calculator, and the difference is HUGE.

If you’re curious about how starting earlier (even with smaller amounts) can set you up for a way more comfortable retirement, this one’s for you.

#RetirementPlanning #RetirementGoals #FinancialFreedom #RetirementIncome #RetirementSavings #RetirementReady #SmartRetirement #FuturePlanning #RetirementStrategy #FinancialIndependence #WealthManagement

Watch video

Your kid’s don’t become hockey players after one practice… but you already knew that. ⚡ It’s the years of showing up, investing in the gear (again and again 🙃), and putting in the time that eventually leads to building the skills.

Saving for your kids’ education works the same way. One deposit into an RESP won’t cover tuition, but those consistent contributions? They add up big over time. Especially since the government is playing on your team and matching you up to 20%. 😉

The earlier you start, the more time those savings have to grow.

So if education is part of your family’s game plan, the best move is to start now. 🏒

👉 Are you set up with an RESP yet?

#CanadianParents #CanadaRESP #InvestInYourKids #EducationSavingsPlan #FinancialPlanningCanada #EducationFundCanada #RESP #EducationSavings #SaveForSchool #FutureEducation #ChildEducationFund #InvestInEducation #EducationPlanning #RESPContributions #KidsEducation #EducationGoals

Saving for your kids’ education works the same way. One deposit into an RESP won’t cover tuition, but those consistent contributions? They add up big over time. Especially since the government is playing on your team and matching you up to 20%. 😉

The earlier you start, the more time those savings have to grow.

So if education is part of your family’s game plan, the best move is to start now. 🏒

👉 Are you set up with an RESP yet?

#CanadianParents #CanadaRESP #InvestInYourKids #EducationSavingsPlan #FinancialPlanningCanada #EducationFundCanada #RESP #EducationSavings #SaveForSchool #FutureEducation #ChildEducationFund #InvestInEducation #EducationPlanning #RESPContributions #KidsEducation #EducationGoals

Your emergency fund doesn’t have to sit idle. 💡

A TFSA can keep it accessible AND help it grow... tax-free.

#Investing #InvestSmart #InvestingTips #InvestmentStrategy #FinancialGrowth #WealthBuilding #LongTermInvesting

#SmartInvesting #PersonalFinance #WealthManagement #FinanceGoals

A TFSA can keep it accessible AND help it grow... tax-free.

#Investing #InvestSmart #InvestingTips #InvestmentStrategy #FinancialGrowth #WealthBuilding #LongTermInvesting

#SmartInvesting #PersonalFinance #WealthManagement #FinanceGoals

Watch video

Have questions?

Here to help answer your questions, provide clarity about products and get you started on the road to achieving your goals.